Multiple targets and stops

Many experienced traders advocate using multiple targets and stops. Building and/or closing positions in steps appears indeed to be a key success factor in trading.

The NanoTrader platform offers unlimited possibilities in this domain. Whatever you have in mind, the NanoTrader is probably capable of handling it.

Automatically handling multiple targets and stops (also called fade in - fade out) is a core competency of the NanoTrader trading platform. Setting multiple stops and targets is easy:

1) The number of stops and targets that can be combined is unlimited.

2) Different types of stops and targets can be combined.

3)

The stops and targets can be set and managed from the chart.

4) Any combination can be saved for future use.

The intelligence managing the stops and targets is remarkable and always operates on the logic of 'the safest combination comes first'.

Once orders have been placed, they can always be changed by grabbing them and sliding them in the chart.

Additional information about multiple targets and stops can be found in the trader forum.

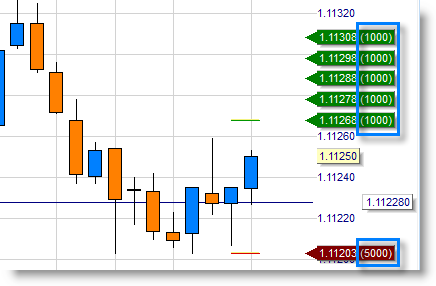

An example

This trader has a 5 targets (sell limit orders) and 1 stop (sell stop order). Either the market goes down and reaches the sell stop. In this case the full position will be sold and all 5 target orders will be cancelled. Or, the market goes up and reaches the first target. In this case 1 lot will be sold and the order size of the stop sell order will be reduced automatically from 5.000 to 4.000.

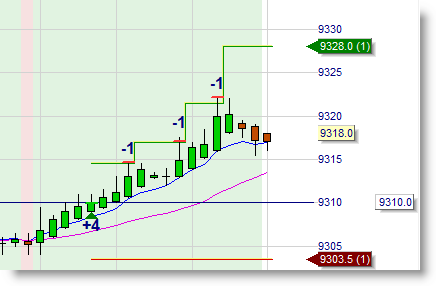

Scalping strategy

T-Line Scalping is one of the more than 50+ free trading strategies integrated in NanoTrader. The strategy uses multiple targets and one stop. In this example the trader bought 4 lots and set 4 different profit targets. Three profit targets have already been reached. Each time the platform automatically reduces the quantity of the stop order. Note: this strategy also uses another unique feature of the NanoTrader. The distance of the targets and the stop are based on the volatility of the instrument instead of a fixed value.

Markttechnik strategy

The NanoTrader trading platform allows users to trade based on Markttechnik as explained by Michael Voigt. The platform is capable of combining Michael Voigt's three exit techniques. Michael Voigt will buy 3 lots, sell 1 manually with a small profit (what he calls break-out trading), sell 1 based on his inside bar trailing stop (what he calls movement trading) and sell 1 based on the zigzag trendline stop (what he calls trend trading). In short, 2 targets and 3 stops.