Hedging

Hedging signifies that a trader can have a long and a short position at the same time on the same instrument. The positions can have the same size (fully hedged) or a different size (partially hedged).

WH SelfInvest offers hedging on both the NanoTrader and the MT4 trading platforms at no extra cost.

Hedging is not a trading strategy, it is a tool. Hedging can be used for different reasons. One example is fully hedging a trading position just before economic numbers are released. Depending on the outcome the position can be un-hedged or closed as required. Another classic example is mixing timeframes. A trader can keep, for example, a short position for several weeks if he believes this to be the main trend. On occasion he can still buy as a daytrade when the market is strong.

Opinions are divided on hedging as part of a trading strategy. Some traders opine that a trader is either long or short, as dictated by his strategy, but not both. Other traders, particularly trend traders, do not like the rigidity of stop orders. They use hedging instead of stop orders to manage positions. Both sides agree that once a trader thinks his position is a loser, he should never hedge it, only close it. This example shows a trend trader who partially hedges his position because he believes the trend deviation is only temporary.

Fully hedged positions

When the long and the short positions are the same size the investor is said to be fully hedged. His combined P&L (profit or loss) will no longer evolve. The loss on the short position is counter-balanced by the profit on the long position or vice versa.

In this example the investor is fully hedged. Being long 1 CFD SP 500 and short -1 CFD SP 500 his combined position is flat (0). The combined P&L is USD 0,20. The combined P&L will remain static unless the trader changes the size of the positions or if a change in the spread occurs.

Some time later ... the P&L of the individual positions has changed but the combined P&L remains USD 0,20.

Partially hedged positions

A position is said to be partially hedged when the long position and the short position are different in size. The P&L of the combined net position will still evolve. The loss on the short position is not counter-balanced by the profit on the long position or vice versa.

In this example the investor is partially hedged. Being long 1 CFD SP 500 and short -2 CFD SP 500 his combined position is short (-1). The combined P&L is USD -1,50. The combined P&L will not remain static.

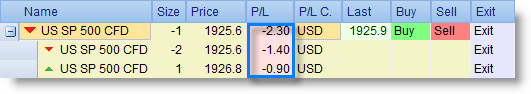

Some time later ... the P&L of the individual positions has changed and the combined P&L has changed to USD -2,30.